3 Easy Facts About Palau Chamber Of Commerce Explained

Wiki Article

Palau Chamber Of Commerce for Dummies

Table of ContentsFascination About Palau Chamber Of CommerceNot known Details About Palau Chamber Of Commerce Rumored Buzz on Palau Chamber Of CommercePalau Chamber Of Commerce Can Be Fun For AnyoneSee This Report about Palau Chamber Of CommerceGetting My Palau Chamber Of Commerce To WorkNot known Details About Palau Chamber Of Commerce The Greatest Guide To Palau Chamber Of Commerce8 Simple Techniques For Palau Chamber Of Commerce

In an effort to offer details to individuals desiring to begin a charitable company in Maryland, the Charitable Organizations Division of the Workplace of the Secretary of State has actually gathered info state below on the necessary actions to develop a charitable organization. While every effort has been made to guarantee the accuracy of the info, please be recommended that specific questions and also info must be routed to the ideal company.

See This Report on Palau Chamber Of Commerce

Before the Internal Income Service can release your organization tax-exempt condition, your company needs to be developed as either an organization, corporation, or trust. A duplicate of the arranging document (i. e., write-ups of unification accepted and dated by ideal state authorities, constitution or write-ups of association, or authorized and dated trust fund tool) need to be submitted with the internal revenue service's Application for Acknowledgment of Exception.To aid non-profit companies, the agency has prepared a standard for articles of consolidation for charitable companies which can be obtained by speaking to the firm. The agency's address is 301 West Preston Street, Baltimore MD 21201, and its telephone number is 410-767-1340. Kinds as well as info can be gotten from the agency's website.

The Ultimate Guide To Palau Chamber Of Commerce

State law, nevertheless, gives the State Division of Assessments and also Taxes the authority to perform routine testimonials of the provided exemptions to make certain ongoing conformity with the needs. While the tax-exempt status issued by the internal revenue service is needed to refine the exemption application, the standing approved by the internal revenue service does not immediately guarantee that the company's residential or commercial property will be excluded.To get an exemption application or details concerning the exception, please contact the State Division of Assessments and Taxation workplace for the area in which the residential or commercial property is located. You might discover a list of SDAT local offices, additional info, as well as copies of the necessary types on SDAT's website.

The Palau Chamber Of Commerce Statements

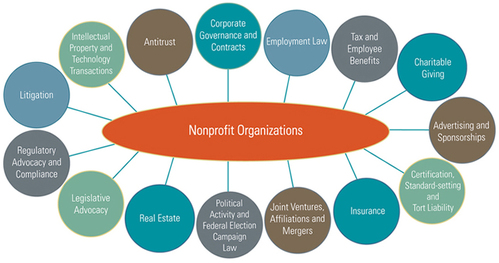

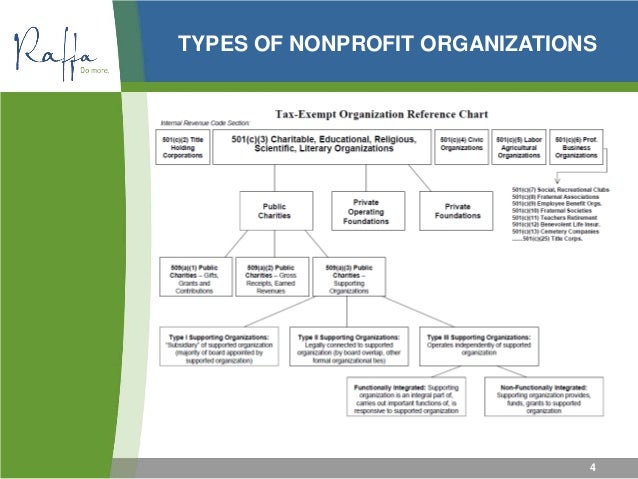

In that means, they also profit their communities. Certain kinds of services that are also categorized as social ventures have the choice of registering their businesses either as a regular company or as a not-for-profit corporation. The company's goal might be the finest sign of exactly how finest to sign up business.It's typical for individuals to refer to a nonprofit company as a 501(c)( 3 ); however, 501(c)( 3) describes a area of the internal revenue service code that defines the demands needed for companies to qualify as tax-exempt. Organizations that get approved for 501(c)( 3) status are required to run exclusively for the function they mention to the IRS.

The Best Guide To Palau Chamber Of Commerce

Any kind of cash that nonprofits obtain have to be recycled back into the organization to money its programs and also operations. Contributors that make payments to corporations visit here that fall under the 501(c)( 3) code might deduct their contributions at the yearly tax declaring day. One of the most notable differences between for-profit and also not-for-profit entities is exactly how they obtain resources to run their businesses.There Are Three Main Types of Philanthropic Organizations The IRS marks eight categories of companies that may be allowed to operate as 501(c)( 3) entities., including public charities, private foundations as well as personal operating foundations.

Palau Chamber Of Commerce - The Facts

Donors for exclusive structures might give away as much as 30% of their income without paying tax obligations on it. Personal Operating Foundations The least usual of the 3 primary kinds of 501(c)( 3) companies is the private operating structure. They resemble exclusive foundations, yet they likewise provide energetic programs, similar to a public charity.They are managed somewhat like personal structures. Both private foundations and exclusive operating structures aren't as heavily looked at as various other philanthropic foundations since donors have close connections to the charity. There are 5 various other kinds of 501(c)( 3) organizations that have certain purposes for their companies, consisting of: Scientific Literary Checking for public safety To cultivate nationwide or worldwide amateur sporting activities competitors Avoidance of ruthlessness to youngsters or pets Businesses in these groups are heavily regulated as well as kept an eye on by click over here now the IRS for compliance, especially with respect to the donations they make use of for political advocacy.

An Unbiased View of Palau Chamber Of Commerce

Not-for-profit organizations are restricted from contributing straight to any kind of political prospect's campaign fund. In enhancement, not-for-profit companies can't campaign proactively for any kind of political candidates.Board Directors and also Members of Nonprofits Have To Follow by All Rule Board directors and also others linked with not-for-profit organizations should understand all regulations that they encounter when functioning in or with a nonprofit organization. For instance, donors can designate just how they want nonprofits to utilize their funds, which are called restricted funds.

The Definitive Guide to Palau Chamber Of Commerce

This area contains analytical tables, short articles, as well as other information on charities and various other tax-exempt companies. Nonprofit philanthropic companies are exempt under Area 501(c)( 3) of the Internal Profits Code.

The Ultimate Guide To Palau Chamber Of Commerce

Report this wiki page